Trying to Understand Coffee Prices

I’ve recently been trying to get a better understanding of the Coffee Market (Coffee C), the way in which coffee prices are set and the impact it has on both ourselves as roasters, and the farmers who grow the crop. These are very early efforts to understand this market and I may leave some glaring holes!

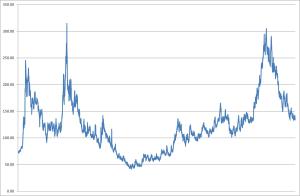

Coffee is a commodity and as such is traded on the stock exchange. Prices for Arabica coffee are set in New York and over time these prices fluctuate greatly. In 2001 the price was around 44 cents per pound, in 2011 it hit 304 cents per pound, a year ago it was around 270 cents while today it sits at 123 cents. In just 12 months the price of coffee has fallen by more than half.

Only a small percentage of coffee is traded through the Coffee C and in terms of Arabica coffee it is restricted to Class 3 Exchange Grade coffee (of which there are 5 classes with Speciality Coffee being Class 1). However, the prices set by the Coffee C have a bearing on global coffee prices.

It seems there are many factors affecting the price of coffee. Many of these are based around production and anything which might impact on this. The current drop in the price of coffee is due to global supply outstripping demand. Similarly an increase in price might be associated with a period of frost in Brazil which results in a smaller than normal harvest. It also appears that influences beyond the world of coffee can have an impact on price. The gambling on coffee futures can lead to fluctuations in price which have no bearing on supply and demand.

So how can this affect the coffee farmers? In the last twelve months the Coffee C has dropped by more than half, to its current level of around 123 cents per pound. During the recent harvests in Colombia, there were riots by farmers and their workers – they had seen the price paid for their coffee cut by half. The short term solution to this problem in Colombia was intervention by the government who offered the farmers a subsidy to ensure a better price for their coffee.

The countries of Central America are being affected by leaf rust, a fungus which decimates coffee harvests. While the over supply of coffee is driving down prices globally, in countries such as Guatemala there is a much smaller harvest than normal. As well as dealing with the fungus, some farmers are also having to contend with lower prices, at a time when they need to invest to protect their crops.

How does the Coffee C affect us as roasters? While we tend to buy speciality coffee, it seems a reasonable assumption that the Coffee C does have an indirect impact on the prices we pay. If the Coffee C is high, and lower grade coffee is selling at a higher price, this must give the farmers more selling power. Similarly if the Coffee C drops, the balance must swing towards the buyer.

However, country specific issues seem to also come into play when dealing direct trade with farmers, or in our case buying from brokers who deal directly. A coffee we used last year is 20% more expensive this year. The coffee is from Guatemala and the increase in price is due to the leaf rust issues mentioned above.

At the moment I have limited understanding of the Coffee C and the impact it has both on the price we pay for green beans, and also for the farmers who grow our coffee. It seems hugely unfair that at times the price set for coffee is so far removed from the product itself and from the issues faced by the people who produce it. As a roaster, having a better understanding of these issues makes us reflect on how we purchase our coffee, particularly as we grow and become more reliant on other suppliers.